🏦📊 Market Extends Probabilities For Fed Rate Cuts Next Year: Cable FX Macro

- Jose Antonio Gutierrez Mares

- Nov 28, 2022

- 1 min read

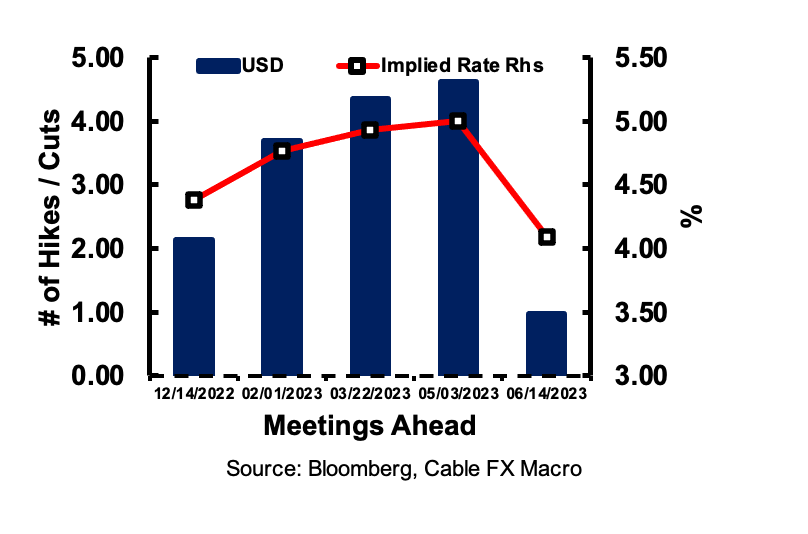

With slowing rate hikes expected in the next few Fed meetings, markets extended the possibility of the Fed cutting in mid-2023. This is mainly due to the deteriorating economic situation, which many believe will force the Fed to pivot early and start easing monetary policy in a bid to support the US economy and job market.

The June tenor on USD swaps slipped to 4.3% by the end of the week from the prior 5.1%

The current outlook is still targeting a 5% rate in early 2023, there is still room for more action on the Fed's part, especially if economic data releases these next few months surprise to the upside.

However, this is not to say that some of these developments are not already priced in

Comments