🇦🇺 Cable FX Macro Weekly Note: Australia Labour Report

- Rosbel Durán

- May 17, 2023

- 1 min read

**As seen in Risk In The Week report 05/12/23, subscribe at cablefxm.co.uk/reports

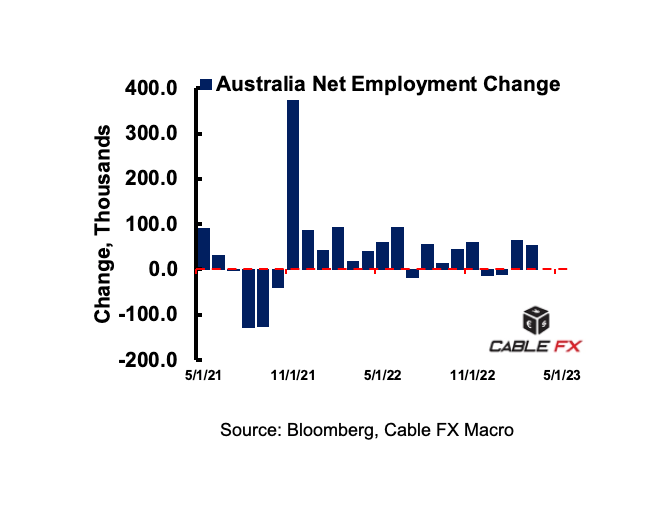

The labour market posted an upside surprise in March, headline net employment change saw an addition of 53K jobs vs the consensus forecast of 20.0K. The March report lifted the three-month jobs average change to +35.4K, this is the highest since November. Another sign of labour market tightness came from the jobless rate, the figure stood at 3.5% vs the consensus forecast of 3.6%. The participation rate ticked higher to 66.7% vs the estimate of 66.6%. For April, ANZ's tracker of job advertisements fell by 0.3% M/m, up from the prior -2.7%, this is the slowest contraction in three months. The uptick in labour position ads could see the unemployment rate stick closer to its record lows, in fact, the Bloomberg median survey sees the figure unchanged from March. Economists at Westpac noted two main drivers for the Australian labour market strength, high job vacancies and a recovery in immigration from pandemic levels. Given these two dynamics, Westpac sees upside risks to employment over the near-term, they have pencilled a 40.0K jobs gain for April, this is the highest estimate in the forecast range. The desk at NAB projects the headline to come in at 25K and the unemployment rate at 3.5%, in line with the consensus. NAB noted that recent Australian population growth estimates suggest that employment growth close to 30K per month is needed for the unemployment and participation rates to remain steady.

Comments