⚠️Yen Front-End Volatility Premium Jumps Heading Into BoJ: Cable FX Macro

- Rosbel Durán

- Apr 24, 2023

- 1 min read

**As seen in Macro Walk report 04/21/23, subscribe at cablefxm.co.uk/reports

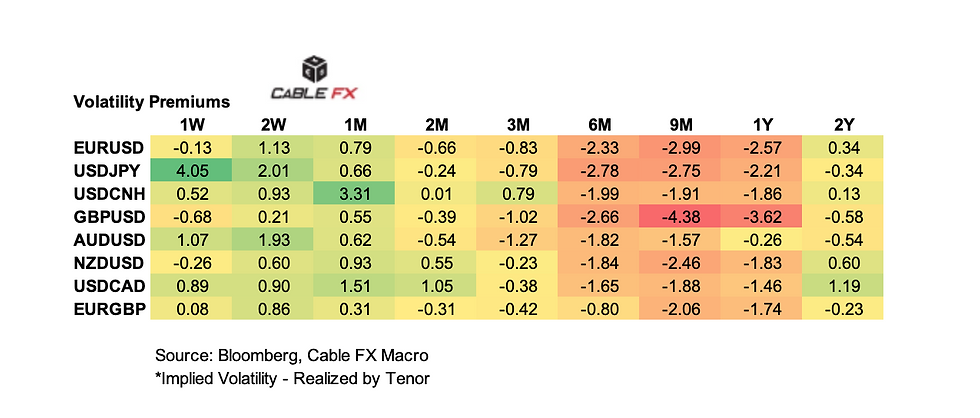

The volatility section in the Macro Walk report showed USD/JPY 1w implied vol spiking higher last week, the 3.1 vols rise left the tenor at 12.31%. This happened as realized volatility fell, pushing the premium above 400bps

Premiums rose as we're set to hear from the BoJ, the central bank will hold its first monetary policy meeting with Ueda as Governor. Implied volatility is rising despite efforts from Ueda to turn down expectations of a policy adjustment, he has said that it is premature to be talking about a tweak in yield curve policy

However, the options market retains a bullish yen bias as 1w 25-delta risk reversals are biased to USD/JPY downside by more than 350bps, the 1m tenor favours puts over calls by 180bps. This would be contrary to the tone we have received from the BoJ and desk commentary as they have pushed expectations of policy shift further out in the calendar

Comments