📝See A Reversal In USD/CAD In The Short-Term: Rabobank

- Rosbel Durán

- Oct 20, 2025

- 1 min read

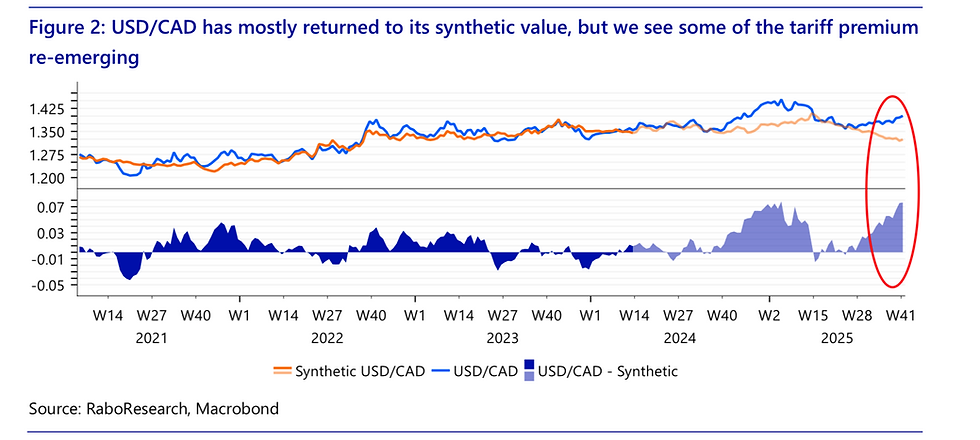

USD/CAD: The tariff premium seems to have priced itself into USD/CAD once again, as USD/CAD is trading above 1.40 – the highest level since April of this year.

We believe that USD/CAD is overbought and see a reversal in the near future down towards 1.38, but we are at a critical juncture where a temporary upside breakout cannot

be ruled out, with a move up to 1.42 likely if we see a confirmed close above the upper band of the bullish channel (which sits at 1.4080 at the time of writing).

Correlations: USD/CAD has lost correlation to many of the assets we track, in favor of becoming pinned to trade-related anxieties and Canadian economic deterioration.

Volatility: USD/CAD volatility remains close to year-to-date lows. The USD/CAD skew had

been largely symmetrical for the past month, but is now shifted in favor of further CAD weakness against USD.

Rates: We are still expecting one more 25bp cut from the BoC after the Bank cut the policy rate 25bp at the most recent meeting and see the terminal rate at 2.25%. However, we find

that the risk to our view is now skewed to two cuts over none. - Rabobank

Comments