📝 Need to See Downside On Non-Tradables For RBNZ to Ease: ANZ

- Rosbel Durán

- Jan 24, 2023

- 1 min read

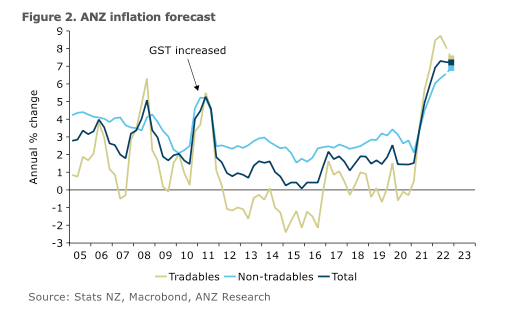

This ongoing domestic inflation surge is probably on borrowed time. The tourism-reopening story is a temporary dynamic; the housing market continues to decline; and forward-indicators suggest domestic demand will ease significantly over 2023. But at the same time, the RBNZ (and we) have been repeatedly surprised to the upside by non- tradables inflation over the past year. So unless we get a reasonably significant downside surprise on non-tradables (and a turnaround in at core inflation measures), it’s not clear the RBNZ will feel they have the flexibility to ease back on the aggressive pace of OCR hikes anytime soon.

For now, we continue to forecast a second 75bp OCR hike will be delivered at the 22 February meeting (with a peak of 5.75% reached by May).

The RBNZ’s aggressive rhetoric has triggered a marked deterioration in consumer and business confidence, and declining job vacancies point towards some normalisation of labour demand in coming months. That should bring inflation down over 2023.

- ANZ

Comments