🧮 Leveraged Funds Trim Dollar Position, Kiwi And Sterling Longs Built: Cable FX Macro

- Rosbel Durán

- Aug 15, 2023

- 1 min read

**As seen in IMM Positioning report 08/12/23, subscribe at cablefxm.co.uk/reports

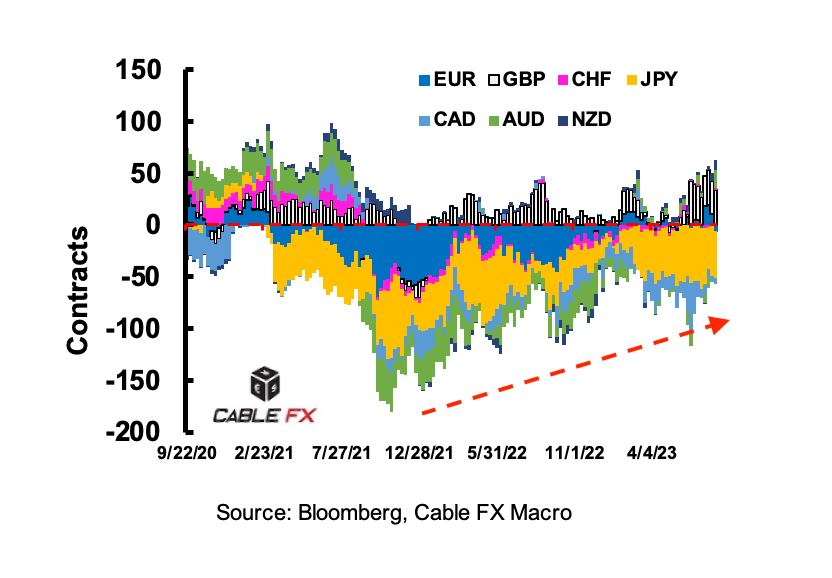

Hedge funds have now pared all bullish bets from the dollar. Using CFTC data and our own in house USD broad cumulative positioning calculator, we found fast money market participants removing their net long dollar exposure

Leveraged funds % of open interest in the dollar is now below 0.0%, the metric had not been negative since early March, last at -0.4%

The dollar has been held as a net long position by the hedge fund community over the course of this year. Last week and March recorded the only instances where % of OI was below 0.0% in 2023, it is fair to question to what extent will the position build further

On the week, sterling and kiwi net long positions were built, the latter is now at the most bullish levels since December 2021. The euro is neutral, while the yen and the loonie stand as the only net shorts

Comments