♻️EUR/USD Detached From Global Risk: Cable FX Macro

- Rosbel Durán

- May 15, 2023

- 1 min read

**As seen in Macro Walk report 05/12/23, subscribe at cablefxm.co.uk/reports

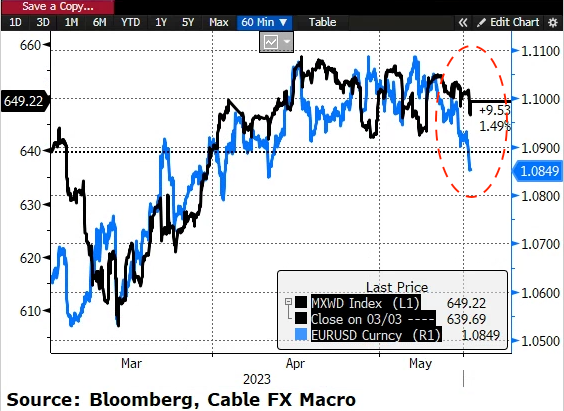

The cross-asset correlation section in our Macro Walk report showed the short-term coefficient between EUR/USD and global risk diverging from its long-term

The bottom table of the cross-asset correlation section shows the difference between the short-term and long-term coefficients. When the figure is negative, as it shows in EUR/USD vs the MSCI All World Index, this means that short-term correlations are no longer statistically valid. In other words, the relationship between two variables is breaking relative to its previous history

The MSCI All World Index has traded relatively unchanged over the month of May, however, the EUR/USD is extending losses. The decoupling has sent the 25-day correlation coefficient to almost null, this compares to the 100-day coefficient of 61%

Comments